Efficiently managing and controlling your financial balance is crucial for achieving financial stability and long-term prosperity. Whether you are managing personal finances or overseeing a business, having intuitive and detailed tools at your disposal can simplify the process and enhance your financial decision-making capabilities. In today's technologically advanced world, leveraging these tools can transform how we approach balance management, making it more streamlined and effective.

The first step in efficient balance management is understanding your current financial status. This involves assessing all income sources, expenditures, savings, and investments. Traditionally, people relied on spreadsheets or even pen and paper to track these components, but today’s digital age offers far more sophisticated solutions. Tools like budgeting apps, personal finance software, and online banking platforms provide users with real-time access to their financial information and a holistic view of their economic health. These platforms often come with user-friendly dashboards that detail spending habits, track expenses, and highlight trends that might otherwise go unnoticed.

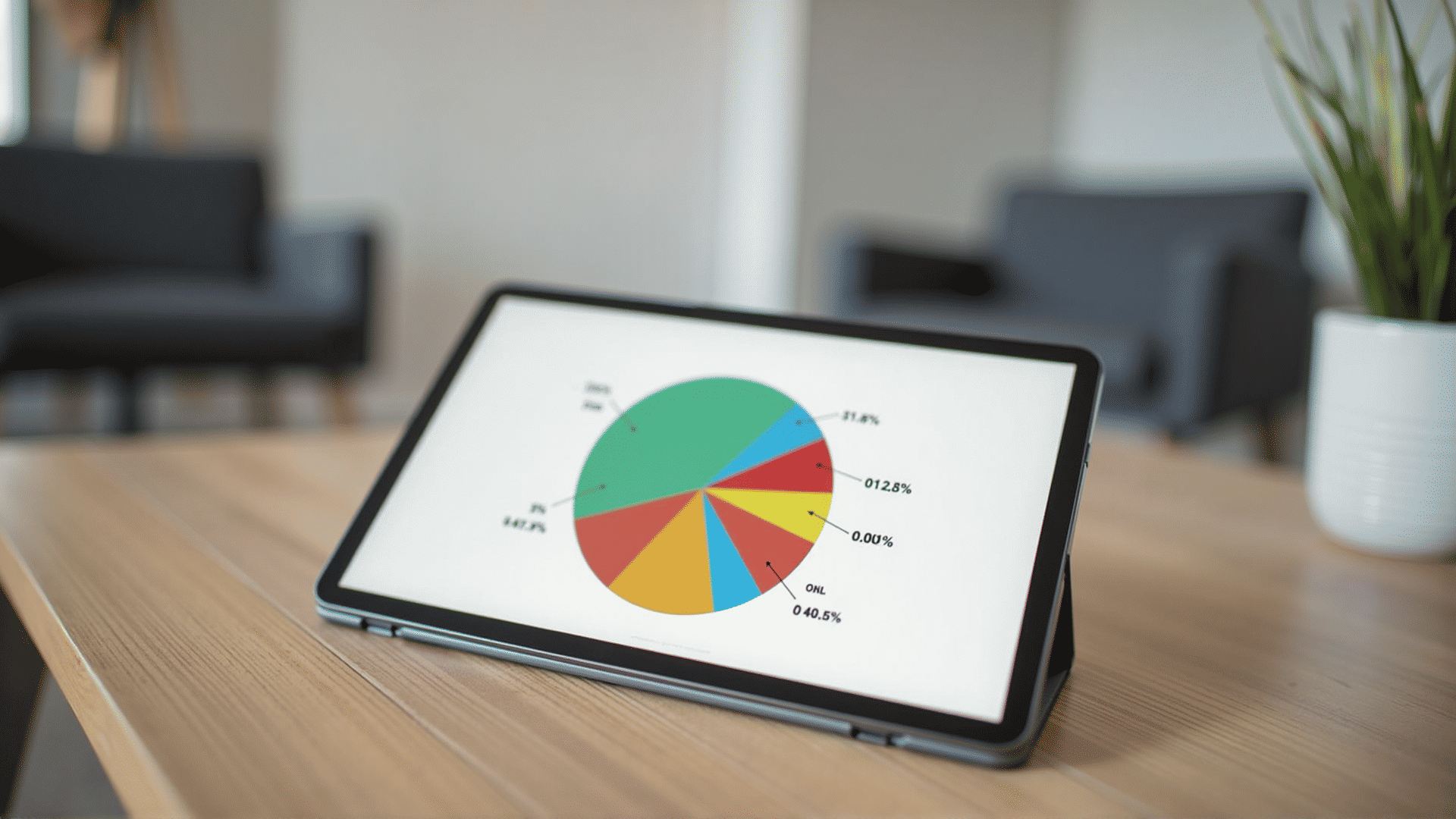

Budgeting apps such as Mint, YNAB (You Need A Budget), and PocketGuard have become increasingly popular for their intuitive interfaces and comprehensive features. These tools allow users to set spending limits, monitor transactions, and receive alerts when nearing budgeted thresholds. By visualizing financial data through graphs and charts, users can quickly identify areas where they might be overspending and make necessary adjustments. This proactive approach helps in maintaining a balanced budget and preventing financial woes before they arise.

Another vital aspect of balance management is goal setting. Whether saving for a vacation, retirement, or a significant purchase, having clear, achievable financial goals is essential. Financial management tools often include goal-setting features that allow users to earmark specific amounts for their dreams. These features automatically adjust savings contributions, track progress, and even provide personalized tips to help meet these goals faster.

Moreover, advancements in artificial intelligence and machine learning have made their way into financial tools, offering predictive analytics. By analyzing past financial behaviors and external economic indicators, these tools can offer insights into potential future financial scenarios. This foresight enables users to make informed decisions to safeguard their financial health against unforeseen challenges.

For businesses, balance management becomes even more complex but equally critical. Sophisticated accounting software like QuickBooks, Xero, and Zoho Books helps business owners manage their finances with precision. These programs offer functionalities that include invoicing, expense tracking, payroll management, and financial reporting. With built-in compliance checks and audit logs, these tools not only streamline operations but also ensure adherence to legal financial standards.

Security is also a paramount consideration when choosing financial management tools. The best solutions employ cutting-edge encryption technologies to ensure that sensitive financial data remain protected from breaches and unauthorized access. Regular updates and patches further bolster defense mechanisms, providing peace of mind to users and businesses alike.

In conclusion, managing and controlling financial balance effectively is no longer just about recording numbers. With the plethora of sophisticated tools available today, individuals and businesses can wield comprehensive, real-time insight into their finances, enabling informed decision-making and strategic planning. As the financial landscape continues to evolve with technological advancements, embracing these tools will not only simplify balance management but will also position users to better navigate the future's economic uncertainties. The key to financial success lies in not just earning but consciously and strategically managing and sustaining a balanced fiscal life.